- August 12, 2025

Trump’s firing of labor data chief: a terrible gamble with America’s future

President Trump’s firing of a top U.S. statistics official after she reported bad economic news has sparked fears that he will begin manipulating government data to paint a rosier picture. When I heard the news, my thoughts immediately turned to my native country, Argentina, where a similar event led to economic mayhem.

Curious about whether the U.S. economy risks a similar loss of trust and a massive capital flight like the one that hit Argentina more than a decade ago, I called several former top Argentine officials and economists who have inside knowledge of what happened in that country.

It turns out there are striking similarities — and some important differences.

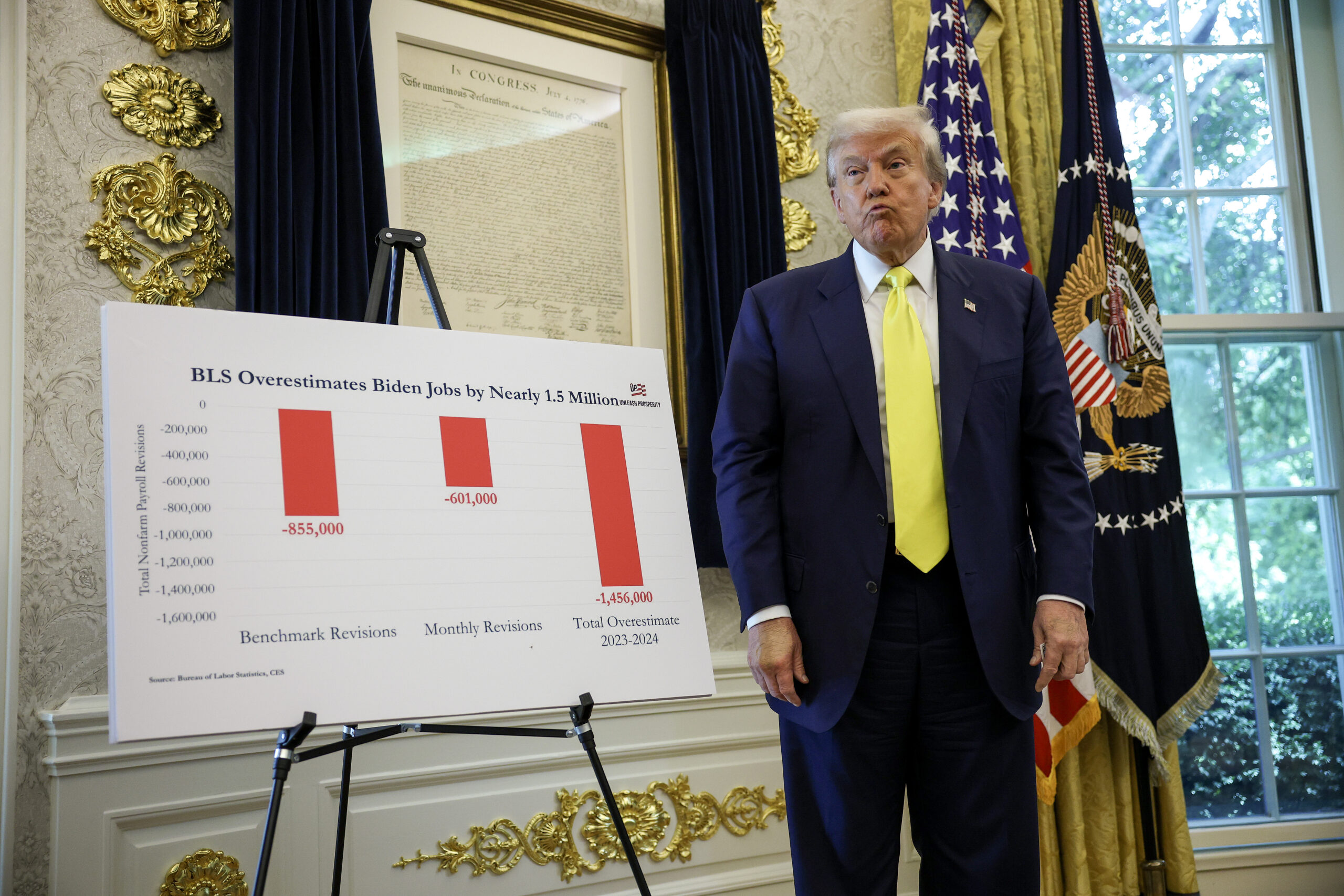

Trump fired Commissioner of Labor Statistics Erika McEntarfer, a career bureaucrat, on Aug. 1, complaining without showing evidence that she had manipulated disappointing new hiring figures released that day. In essence, he fired the messenger of bad news.

Trump said in his social media that “today’s jobs numbers were RIGGED in order to make the Republicans, and ME, look bad.” He announced that she would be replaced with “someone much more competent and qualified.”

The news drew alarm bells, especially since it followed months of repeated threats by Trump to Federal Reserve chief Jerome Powell for resisting his calls to lower U.S. interest rates. The credibility of U.S. economic data, a bedrock of the U.S. and global economies, was suddenly in question.

A headline in The Wall Street Journal read, “The president’s move throws the quality of America’s statistical apparatus into question.” The message from economists was clear: If U.S. data are no longer trusted, foreigners and domestic investors will take their money elsewhere. Swiss bankers may already be salivating.

Martin Redrado was the president of Argentina’s Central Bank at the time when late President Nestor Kirchner intervened in his country’s official INDEC economic statistics institute in 2007, and he said it was “the beginning of Argentina’s slow-motion financial collapse.”

Redrado told me that the Central Bank he presided over even started disregarding the INDEC’s official statistics in its published reports, and instead relied on private economic figures. Between 2007 and 2015, Argentina’s populist government fired growing numbers of respected INDEC statisticians, a move that further damaged the credibility of official data and drove investors to sell Argentine bonds.

“The United States still has stronger institutions than Argentina had at the time,” Redrado told me. “But if Trump fired the head of the Federal Reserve, it would put the United States in the same category as Argentina was back then.”

Fausto Spotorno, head of the Institute of Economics at Argentina’s UADE University, told me that people shouldn’t read too much into the fact that the U.S. stock market didn’t sink on its first session after McEntarfer’s dismissal.

“In Argentina, the loss of confidence in government data was a gradual process,” Spotorno said. “It took years of growing government intervention in official statistics before the markets panicked.”

Typically, after the 2007 intervention of the INDEC, the Kirchner administration would privately press food companies to lower the prices on some of their products, and then order government statisticians to pick those goods to measure inflation, Spotorno said.

In effect, the government would tell a company, “Lower the price of that product, and do whatever you need to do with the prices of your other products.” Then, it would ask government statisticians to measure the lower-priced goods when measuring inflation data.

Marcelo Giugale, a former top World Bank official and Georgetown University economist who follows Argentina’s economy closely, told me that Trump’s firing of the Labor Department’s top statistician “is very bad news for the United States and for the world.”

“It’s like if the pilot of the world’s biggest aircraft sees that the plane is losing altitude, and instead of checking what’s going wrong, and consulting with the co-pilot and experts on the ground, takes a hammer and smashes the dashboard,” he said. “That’s what Trump did by firing McEntarfer.”

Giugale added that America still has other government statistics offices that are likely to continue putting out truthful figures, but cautioned that people’s distrust may extend to them. “Distrust is contagious,” he said.

“If people start distrusting labor statistics, they may soon distrust inflation, tax collection and all other government figures,” he said. “Likewise, if the government puts out good economic news, nobody may believe them.”

In Argentina, lack of trust in government data led to capital flight, rampant inflation and a debt crisis. Argentina is still trying to recover investors’ confidence, even after President Javier Milei started making draconian free market reforms in 2024.

The bottom line is that Trump’s firing of the statistician in charge of employment numbers may not by itself be a harbinger of disaster. But if he follows through with his threats to effectively take control of the Federal Reserve, as he has done with the Justice Department and other government agencies, it may be the beginning of the end of America — and the U.S. dollar — as the world’s most stable economy.