- March 24, 2025

Trump Administration’s Use of IRS Data in Immigration Enforcement Sparks Controversy

The Trump administration has recently taken steps to access confidential taxpayer information from the Internal Revenue Service (IRS) to aid in immigration enforcement efforts. Specifically, the Department of Homeland Security (DHS) requested that the IRS provide last-known addresses, phone numbers, and email addresses of approximately 700,000 undocumented immigrants identified for deportation. Additionally, DHS has sought the deployment of IRS auditors and criminal investigators to scrutinize businesses suspected of employing individuals without legal work authorization.

In response to these developments, immigrant advocacy groups, including Centro de Trabajadores Unidos (CTU) and Immigrant Solidarity DuPage (ISD), have filed a lawsuit against the Treasury Secretary and the IRS. The legal action aims to prevent the potential misuse of IRS data against immigrant taxpayers, citing concerns over privacy violations and the legality of such data sharing.

Critics argue that diverting IRS resources from tax enforcement to immigration matters could undermine public trust in the tax system and reduce tax compliance among immigrant communities. They also warn that such actions may lead to decreased public revenues, as undocumented immigrants contribute significantly to federal, state, and local taxes.

These initiatives are part of a broader strategy by the Trump administration to intensify immigration enforcement, including the issuance of an executive order aimed at ensuring that taxpayer resources are not used to support illegal immigration.

From Trump Wants to Use the IRS to Track Down Immigrants. They May Stop Paying Taxes by Adrian Carrasquillo, published in The Bulwark.

Undocumented immigrants pay taxes, which is sadly a widely unknown fact. U.S. law requires anyone with reportable income to pay taxes, regardless of immigration status. Staying current on taxes can help with future residency or citizenship applications, while failing to pay can create legal obstacles.

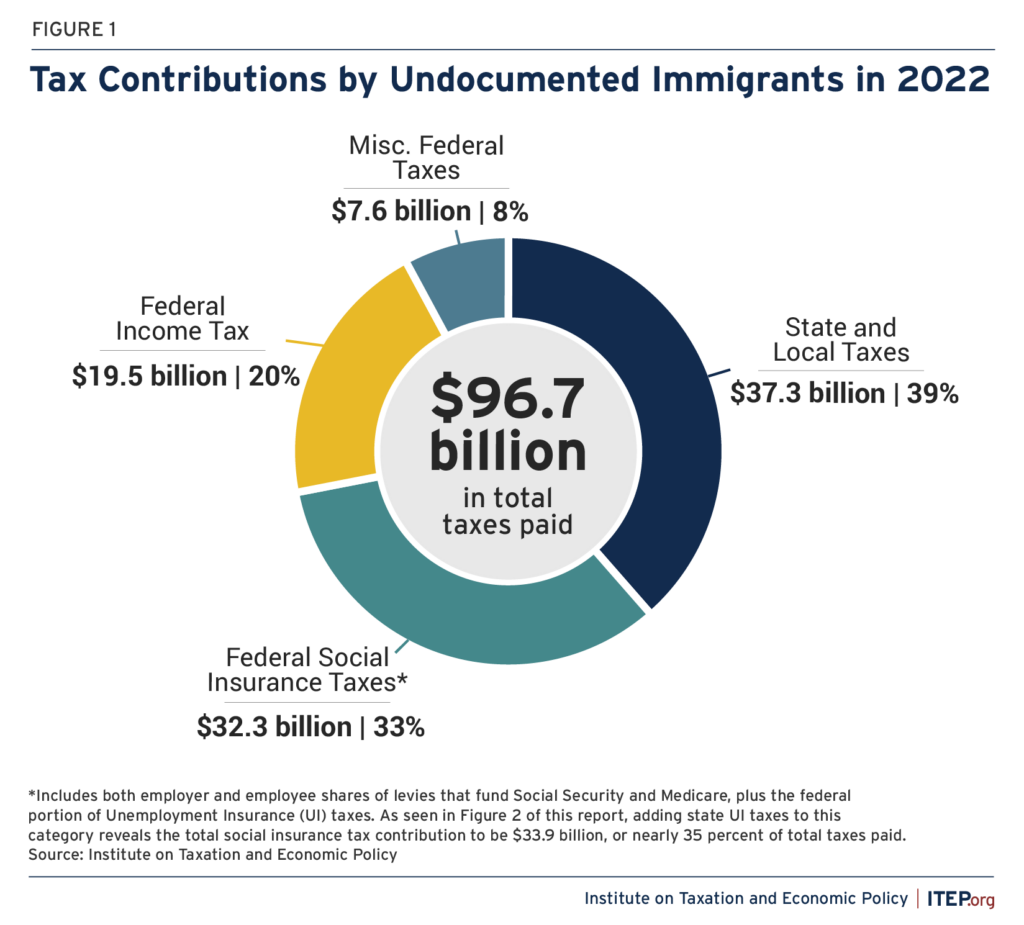

These tax contributions significantly benefit public services. A 2022 study from the Institute on Taxation and Economic policy found that undocumented immigrants contributed nearly $60 billion to the federal government and $37 billion to state and local governments in 2022, averaging $8,889 per person. “In other words, for every 1 million undocumented immigrants who reside in the country, public services receive $8.9 billion in additional tax revenue,” the report stated. These payments help fund Social Security, even though undocumented workers cannot access those benefits.

Pro-immigrant advocates warn that increased deportations could weaken the social safety net by reducing tax revenue. Americans for Tax Fairness is among the groups countering claims that undocumented immigrants are a financial burden, emphasizing their contributions to essential industries and tax revenue. “These are workers that are positively contributing to our communities—they’re our neighbors and coworkers who are contributing not just through their labor in critical industries like agriculture and construction, but they’re paying their taxes and don’t get benefits back,” stated Pablo Willis, the group’s communications director. “Meanwhile, Elon Musk’s entire business empire is based on federal subsidies, and Tesla didn’t pay taxes last year.”